(click on a question below for a drop-down answer, then contact John if you want further information about your estate planning law question or estate administration question)

Estate Planning FAQs

1. What is Estate Planning?

An estate plan is a plan to handle your assets if you become incapacitated, and to distribute your assets at your death. A plan can be very simple, e.g., a will, or involve one or more trusts and related documents. Most people can benefit from an estate plan. The type of estate plan you need depends on your assets and your ideas about who should receive your assets at your death.;

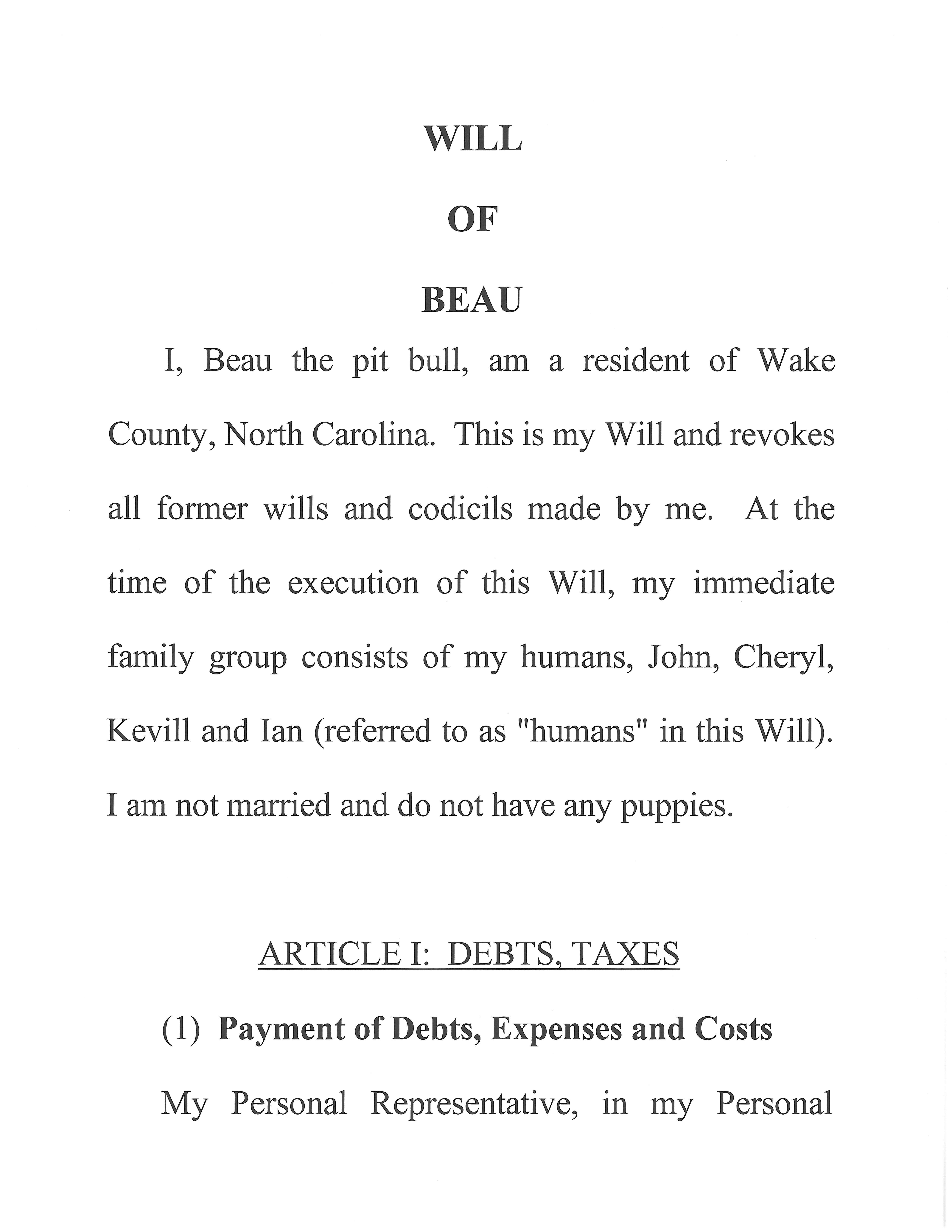

2. What is a Will?

A will is a legally valid document which typically names someone to manage the person's assets after death and describes how the assets are to be distributed after debts and expenses are satisfied.

3. Does a will dispose of all of property?

Disposition of certain assets known as "nonprobate" property is usually not governed by a will. These can include:

• qualified retirement plan benefits such as pension, profit-sharing, 401(k), 403(b) annuities

• individual retirement accounts or individual retirement annuities

• life insurance and other annuities

• real estate owned as “tenancy by the entirety” or “joint tenancy with right of survivorship”

• joint bank accounts with right of survivorship

Nonprobate assets require paperwork extrinsic to a will, for example, a deed to real estate, a death beneficiary designation, or a bank signature card.

4. How does a trust work?

A "trust" can be a living trust, meaning it takes effect during your life, or it can be a testamentary trust, which is incorporated into your will and takes effect when your will does, i.e., after your death.

There are many different reasons for having a trust, including:

• charity

• care of surviving spouse,

• preservation of capital,

• financial management,

• care of beneficiaries who are inept with money.

A trust has the following components:

A “settlor” (also known as a “grantor”): This is the person who is going to be creating the trust.

A “corpus:” this is a Latin term meaning the property that is going into the trust, cash, real estate, or whatever it might be.

A “trustee:” this is the fiduciary (person or institution) named by the grantor to administer, manage or be responsible for the trust corpus. Like the name suggests, it should be somebody you trust. So, for example, you might not want to name your brother-in-law who just got out of prison for armed robbery.

“Beneficiaries:” these are people or organizations who are going to benefit from the grantor's trust property according to the terms that the grantor prescribes.

5. What rules govern lifetime gifts?

As part of your estate plan, you can give property away while you are still alive rather than wait until after you are gone.

An advantage of lifetime giving is that you don’t have to worry about whether it will make its way to your beneficiary after your death. However, keep in mind that lifetime gifts might trigger adverse federal or state gift or, more likely, income tax consequences.

For instance, under federal law, a donor can give an unlimited amount to a spouse or charity, but to any other beneficiary this is generally subject to an annual limitation before it starts counting against your “unified credit” (see next question).

This annual limitation is currently $13,000.00 per donee ($26,000.00 per married couple) per donor.

6. How do estate and gift taxes work?

Under federal tax law there is concept known as a “unified credit.”

This means that a person under federal law is allowed a certain amount of property that can be transferred either during lifetime or after death to non-spousal/non-charity donees (like with the annual exclusion, lifetime or post-death transfers to spouses/charities are unlimited).

The figure for 2019 is over eleven million dollars per taxpayer, (which can mean ten million dollars total for a married couple if proper planning is done).

North Carolina previously had inheritance and gift taxes, but these were repealed in the last several years. North Carolina still has an estate tax that can apply to larger estates.

7. What are"fiduciaries" and how do they affect estate planning?

A “fiduciary” is someone who is legally considered to be in a special relationship with you and who is supposed to be looking out for your best interests.

For your will, the person whom you name as your executor, or if you die without a will, the person who will serve as the “administrator” – either of whom is sometimes also referred to as your personal representative, is a fiduciary. This is the person who will be in charge of administering your will and estate plan, or the laws of intestacy if you die without a will.

The executor can be your spouse, child, sibling, trusted friend, banker or whoever.

You don’t want to pick this person based on sheer emotion, because whoever you pick is legally liable if something goes wrong.

You want someone who is competent enough to handle banking transactions and honest enough not to misappropriate money or property.

The personal representative can hire an attorney for help if desired.

A personal representative is entitled to compensation from your estate unless you say that the service will be done without pay.

If you want to use a bank as executor the bank won’t do it unless the bank can charge according to its established fee schedule.

If you utilize trust provisions in your estate plan, whoever is named as your trustee (it can be the same person as your personal representative) will also be considered a fiduciary and should be picked with the same considerations as for your personal representative.

You can pick one or more backup executors, trustees and other fiduciaries, in case something happens to the first choice.

You are free to require that multiple fiduciaries act simultaneously, but it can be cumbersome, especially if they don’t all live close to each other.

8. What should be done after the will and other documents have been signed?

For my clients, once the will and other documents are signed and notarized, I give the originals to the client to keep. I also email a pdf file to the client and tell the client to email the pdf to the executor, the trustee, etc.

The original of your will and other documents should be kept in a safe place and you should disclose this location to the people who should know where it is.

Another thing is to be sure to let family members know about your wishes for cremation, burial, or whatever. If you fail to address this topic anywhere except in your will, by the time your grieving survivors remember to look at the will, there are probably none of your remains remaining. It’s hard to bury you if your ashes have already been scattered at sea.

9. Who will take care of young children if both parents die?

If you have any children under age 18 at the time of your death, it is up to the Clerk of Superior Court to appoint a guardian to take physical custody of them.

However, you may add a recommendation in your will which under North Carolina law is to serve as a “strong guide” to the Clerk in appointing a guardian.

10. How do powers of attorney and "living wills" work?

A "durable power of attorney" covers the situation when you are still alive but can’t competently pay your bills, or otherwise look after your financial affairs, because of some mental disability or incapacity. It gives somebody, or several somebodies, either simultaneously or in the alternative, the power to do what you are unable to do, such as pay bills.

A "health care power of attorney" is like a regular power of attorney except that it gives the power to make health care decisions to whomever you designate when you can’t make those decisions.

A "living will" (also known as a "declaration of desire for a natural death") directs the withholding or discontinuance of artificial nutrition/hydration (i.e., "tube feeding") or extraordinary means such as heart defibrillation if your physician determines you are in a persistent vegetative state or terminally ill.